Executive Summary

The plant-based market is huge and growing worldwide, with demand rising across the US and Europe. This demand is being driven largely by flexitarians and reducetarians, who are increasingly looking for plant-based alternatives. This presents a huge opportunity for food-service businesses to attract new consumers.

Based on our consultations with food-service professionals across Europe, we have identified five key recommendations:

- Lead with flavor

- Showcase sustainability

- Consider the flexitarian consumer

- Harness the health benefits

- Add a range of plant-based entrees to your menu that fits with your brand

Introduction

With a third of consumers choosing to actively reduce their meat and dairy consumption and seeking protein substitutes driven by health and environmental concerns,1 this report aims to inform, inspire, and empower leading businesses in the food-service industry to think differently about the potential of the plant-based sector and to respond to these shifts in consumer demand. By sharing insights into how to improve and increase plant-based options on food-service menus, you will discover how putting delicious and affordable products on consumers’ plates can help to accelerate your business, increase your consumer base, and position you as a leader in the future of food.

The plant-based sector in general

The growth of the plant-based sector is continuing to accelerate, with Europe’s plant-based-sector predicted to balloon to €7.5 billion in the next five years.2

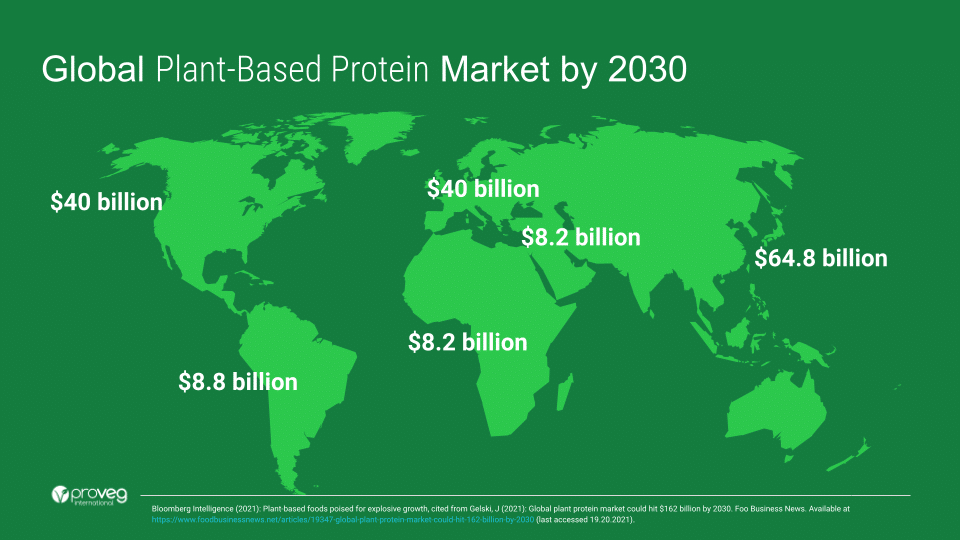

A new report has predicted that, globally, the plant-based sector will exceed $162 billion within the next decade. The sector was valued at just $29.4 billion in 2020, which means that if these predictions are correct, it will soar in value by 451%.3

Major plant-based meat and dairy brands such as Beyond Meat, Impossible Foods, and Oatly are driving some of this growth, with their partnerships with restaurants and fast-food chains around the world making plant-based options more accessible to the mass market.

The Asia Pacific region is likely to dominate the plant-based protein market, reaching sales of $64.8 billion by 2030, with both North America and Europe accounting for $40 billion within the same time frame. It is also forecast that the Middle East and Africa will reach $8.2 billion and Latin America will reach $8.8 billion.4

When it comes to breaking this down into categories, it is predicted that sales of plant-based meat and fish alternatives will constitute 5% of the total meat and fish sectors by 2030, while plant-based dairy is predicted to constitute 10% of the total dairy sector by 2030, up from 4.5% in 2020.5

Plant-based milk is the most mature product category, with sales currently making up almost 15% of total milk sales globally.6

The growth of plant-based options in restaurants

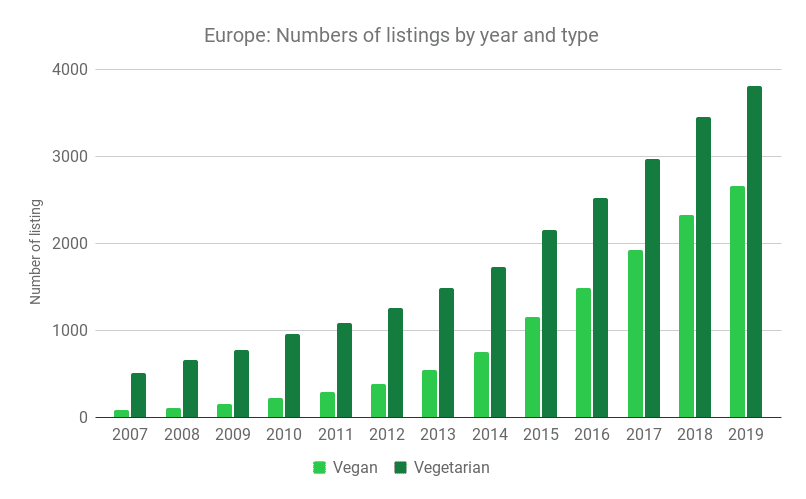

This trend of accelerated growth is also evident when it comes to restaurants. In 2007, there were only 85 vegan restaurants in the whole of Europe. Today, there are more vegan restaurants than this, just in London alone! By the end of 2019, the number of fully vegan restaurants in Europe was more than 2500 – and that’s not including the number of fully vegetarian restaurants, which surpassed 3600 in 2019.7

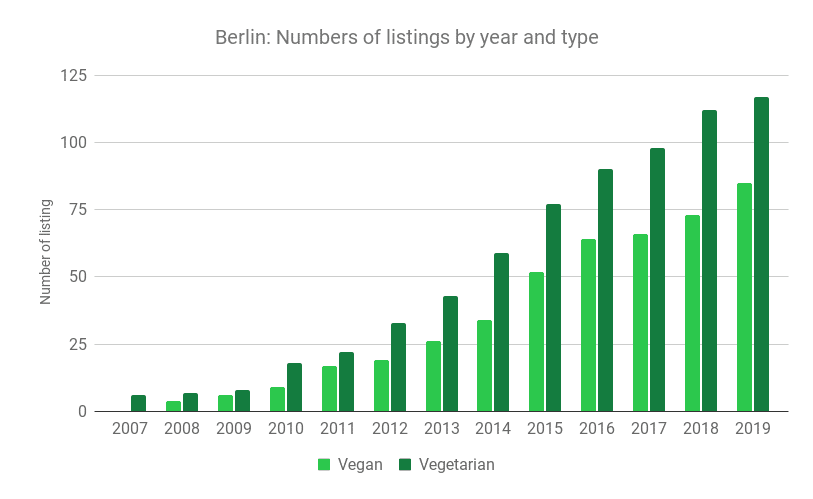

In 2019, Berlin took global third place on HappyCow’s list of Top 10 Vegan Friendly Cities, and was number two in Europe. While it has about half of the number of vegan restaurants compared to London, it still had more than 80 vegan eateries in 2019, which is impressive nonetheless.9

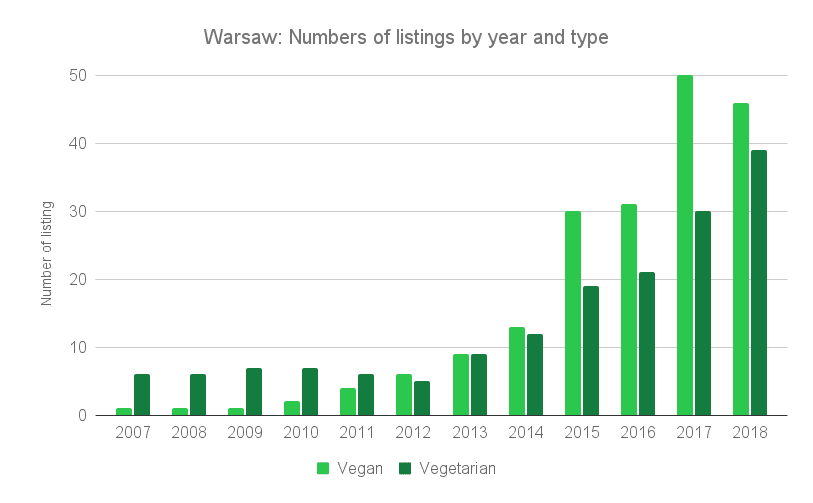

Warsaw took the number-six spot on the Top 10, and has experienced an incredible evolution. Before 2009, there was just a single vegan restaurant listed on HappyCow, but, by the end of 2019, there were more than 50! To top that, Warsaw appears to have embraced veganism quicker than vegetarianism – since 2014, there have consistently been more vegan eateries than vegetarian.10

And it’s not just vegan and vegetarian restaurants that are changing the landscape – according to a study by Foodable Labs, 5% of chefs in the United States added vegan items to their menus in 2018. The study also found a 31% increase in the number of plant-based menu items in the US.13

2020 also saw an increasing number of partnerships between plant-based brands and mainstream food-service companies as they expanded their menus, with international expansion being a key theme.

- Starbucks partnered with Beyond Meat to launch several new plant-based-meat items in its stores in the UK and China.14

- KFC debuted plant-based chicken nuggets from Cargill in China.15

- Tyson announced that it would sell Raised & Rooted’s plant-based-meat line in the European food-service sector.16

- McDonald’s announced its McPlant product line in the UK and USA.17

In addition to brand-restaurant collaborations, more adventurous eateries such as Nick’s Kitchen, a Filipino restaurant in California, have executed complete brand overhauls and switched to 100% plant-based menus. By going plant-based, Nick’s Kitchen has achieved a 1000% increase in gross sales, set against a 433% increase in food costs, illustrating the huge potential of adding plant-based products to menus.18

Vegan restaurants are now also achieving every chef’s dream and winning Michelin stars. ONA, a small restaurant in France, won a Michelin star earlier this year, making it the first vegan restaurant in the country to do so. In a nation famed for its love of steak tartare and foie gras, the coveted star is a recognition that, in terms of taste and the overall eating experience, vegan food can compete with the very best.19

Drivers of growth

While the food-related habits of consumers often come and go as fads, plant-based alternatives are clearly here to stay – and are continuing to grow – because, to put it simply, consumer demand is shifting, with nearly a quarter of the European population now actively reducing their meat intake.20

Within the last four years alone, the number of vegans in Europe has doubled from 1.3 million to 2.6 million, now representing over 3% of the population. However, when you include vegetarians, pescatarians, and flexitarians, the group in total represent about 40% of the population – meaning that over a third of all Europeans no longer view themselves as conventional meat eaters.21

Flexitarians represent the market segment that is experiencing the fastest growth, now constituting almost 30% of Europeans. And 57% say they want to gradually eliminate meat from their diets entirely.22

And it’s not just the flexitarian sector that’s shifting away from meat – 27% of mixed eaters are also becoming more open-minded about plant-based alternatives.23

The US market echos European trends

These shifts are also taking place in the North American market, where consumer awareness and interest in plant-based foods have continued to rise dramatically, with many plant-based products gaining mainstream status. According to a 2020 Gallup poll, a significant and increasing percentage of US consumers have eaten, or are at least aware of, plant-based-meat products:

- Half of US consumers are familiar with plant-based meat products.

- 41% of US consumers have tried plant-based meat.

- Of Americans who have tried plant-based meats, 60% are very or somewhat likely to continue eating them.24

Even more interestingly, 80% of US consumers think that the recent shift toward plant-based diets is a significant and long-lasting trend.25

For more information about consumer attitudes towards plant-based foods, please download our report What consumers want: a survey on European consumer attitudes towards plant-based foods, with a focus on flexitarians.

So, as you can see from these growth figures, plant-based foods represent one of the biggest stories in the food sector for the next decade.

The impact on the food-service sector

The expanding set of product options in the sector is contributing to plant-based products becoming a long-term option for consumers around the world. As a result, consumers now expect tasty and convenient plant-based options in all food settings – and products in this category are innovating rapidly in response.

Chefs and food-service businesses can play a key role in accelerating this shift and will benefit strongly from the growth in consumer demand for plant-based options. At a time when the world population is re-evaluating their lifestyle and dietary choices, it’s essential for chefs and food-service professionals to prepare for and support the global shift towards healthier menu lines that provide more plant-based options.

While plant-based products offer sustainability and nutritional advantages – which we’ll cover in more detail shortly – the most persuasive reason to include them in your menu line is the positive impacts that they can have on your business.

With that in mind, here are eight key reasons why you should consider expanding into the plant-based market – if you haven’t already:

1) Food-service sales of plant-based foods are increasing

We saw earlier that the overall plant-based sector is experiencing explosive growth. But how does food service fit into this? Well, data shows that, in Europe, menu penetration of the term ‘vegan’ grew by 490% between 2008 and 2018, with many restaurants reporting that adding plant-based offerings to their menu has attracted new customers.26

Pret A Manger first noticed the rise in popularity in 2016, when sales of their vegetarian dishes increased by double digits. They responded quickly – launching 20 new plant-based dishes the following year, and have continued growing their plant-based range ever since, launching 15 new vegan products in 2020 and an additional nine products in 2021.27

Umami Burger started carrying the Impossible Burger in 2017, and found it to be the number-one driver of new sales chainwide – since 2021, it has accounted for a third of all their burger sales.28

Similarly, since Wagamama re-opened in 2021, post-pandemic, for dine-in customers, it has seen consistently strong trading, with like-for-like sales growth of 21%, outperforming the overall market by 13%. The company’s commitment to a 50% plant-based menu in their UK branches by the end of 2021 was highlighted as a key driver of this growth.29

Recently, the NPD Group found that US shipments of plant-based protein from food-service distributors to pizza operators jumped by 56% in the second quarter of 2021. Shipments of plant-based chicken analogs to operators increased by 98% compared to a year ago, while shipments of plant-based Italian sausage grew by 72%.30 These figures clearly illustrate the growing demand for plant-based products on restaurant menus.

2) Flexitarians love plant-based foods

We spoke earlier about the growing number of flexitarians globally, and, interestingly, most of the sales growth in the plant-based sector isn’t coming from vegans, vegetarians, or consumers with allergies, but from flexitarians who are reducing their consumption of animal-based protein in favor of increased plant protein.31

Research shows that 70% of Beyond Meat’s consumers are flexitarians, and that nine out of 10 US consumers who purchase non-dairy milk also purchase dairy milk.32

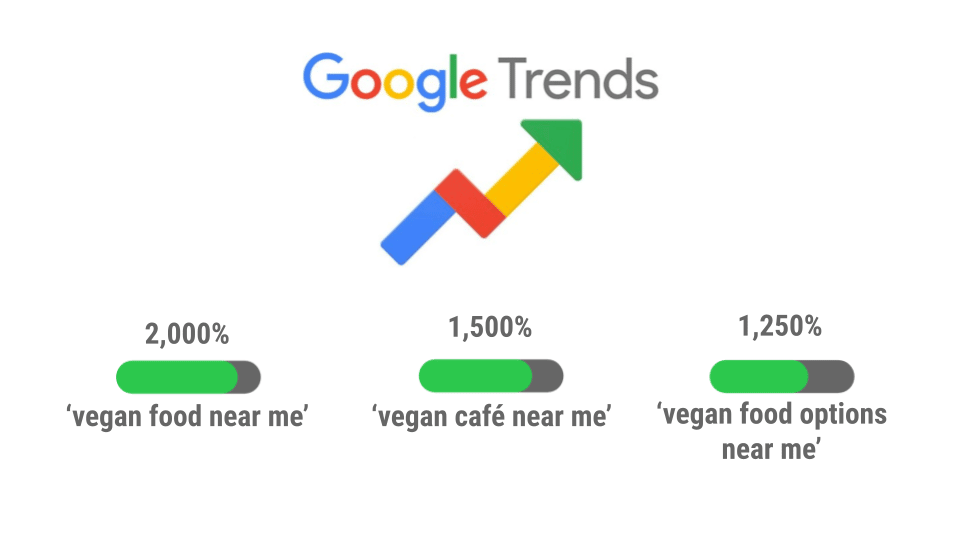

A recent Google Trends analysis from October 2015 to October 2020 showed that interest in vegan food options is increasing, with Singapore, Sweden, Norway, Denmark, and Finland experiencing the biggest increases.33

Search terms that saw major growth on a global scale included ‘vegan food near me’ (which increased by 2,000% during the 5 year period), ‘vegan café near me’ (up 1,500%), and ‘vegan food options near me’(up 1,250%).34

Plant-based menu options are widely sought after by flexitarians and are no longer aimed only at the small proportion of vegan and vegetarian consumers.

3) Plant-based options appeal to Millennials and Gen-Z consumers

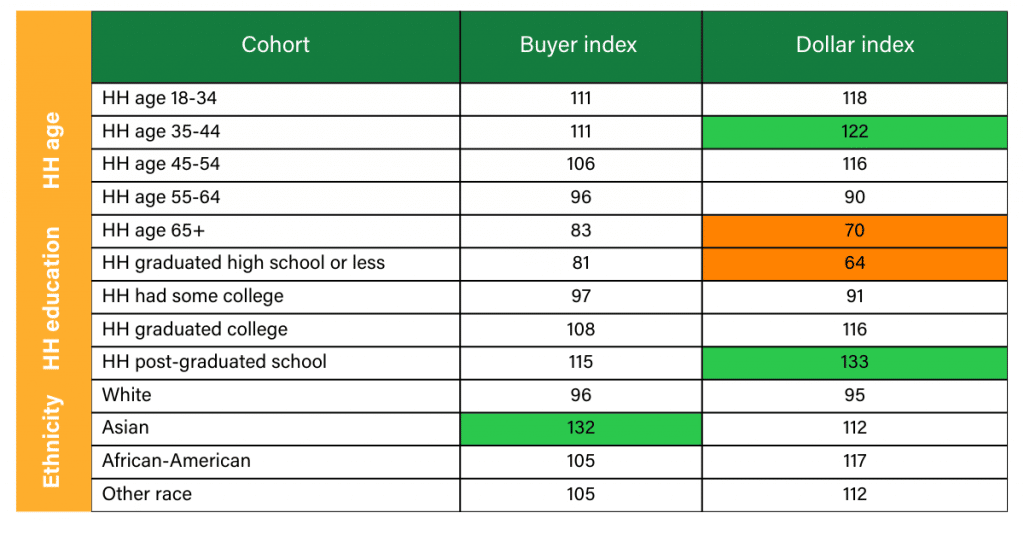

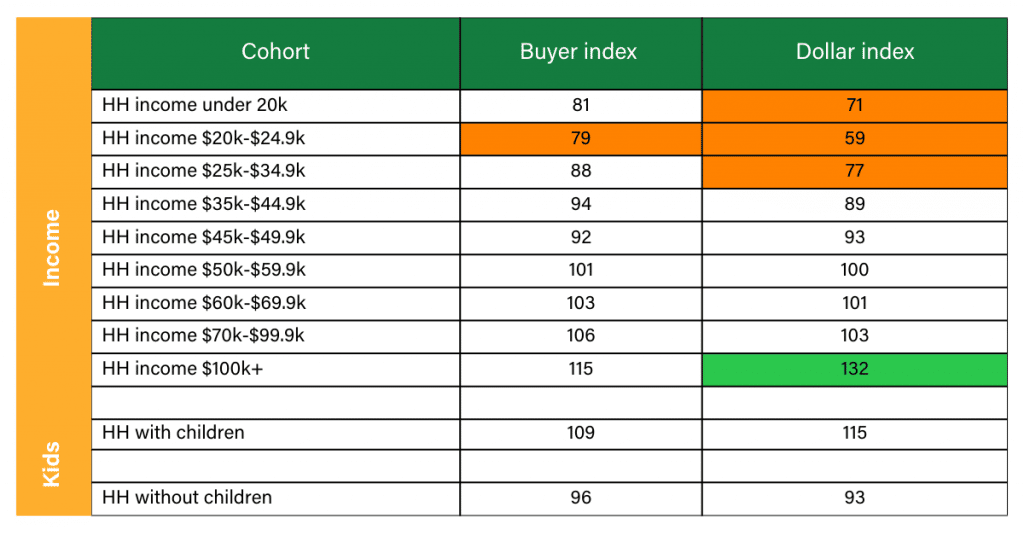

The younger generations, including Millennials and Generation Z, are the driving force behind the explosive growth of the plant-based sector. In general, flexitarians tend to be young women – 55% of US millennials and 24% of US Gen Z – and they also tend to be educated, well-read, politically liberal, and big users of social media.36

A study by GFI echoes this, finding that purchasers of plant-based products tend to be younger and from higher income brackets than the average consumer.37

Note: The data presented in this graph is based on custom-GFI plant-based categories that were created by refining standard SPINS categories. Due to the custom nature of these categories, the presented data will not align with the standard SPINS categories. (Data source SPINS X Good Food Institute).38

When it comes to Gen-Z consumers, 65% say that they want a more ‘plant-forward’ diet, while 79% choose to go meatless once or twice a week. Gen-Z consumers are more likely to integrate vegetarian options into their diets without making a decision to go fully vegan or even vegetarian. They see vegan options as just another choice on the menu.39

And, according to a 2017 report by Mintel, 79% of US millennials eat meat alternatives, with 30% eating meat alternatives every day and 50% eating meat alternatives a few times a week, behaviors that have likely accelerated over the last four years.40

4) Health is a growing motivation for consumers

Numerous studies illustrate that of the key drivers for consumers to adopt a plant-based diet, health remains key.

In a recent study conducted by ProVeg as part of the Smart Protein Project, we asked flexitarians across 11 European countries about the most important factors when choosing a plant-based food product. The results show that taste and health are the most significant purchase drivers – around 2,000 of the 7,500 flexitarians that were surveyed stated that it is important to them that the plant-based food products that they choose are tasty and healthy.41

It is now widely accepted that a plant-based diet offers numerous health benefits compared to a diet centered on animal-based products. Plant-based diets are typically higher in fiber and less calorie-dense than other diets, providing weight-management benefits to consumers. Since almost all plant-based foods are naturally free of cholesterol and saturated fats, putting plant-based options on menus can be a great way to appeal to consumers who crave a healthier but still tasty choice.

5) Sustainability is a growing motivation for consumers

One of the biggest shifts currently taking place is that the health of the planet is now a key concern for consumers, with an Innova study illustrating that consumers purchase plant-based products because they consider them to be better for the planet. Although it might not be the top purchase driver for all consumers, for many people it does seal the deal when it comes to product choice.42

Sustainability has also become a central theme for companies. Increasing the number of plant-based menu items and ingredients is one of the most effective ways to reduce your company’s environmental impact. A plant-based diet uses fewer resources and less land and emits fewer greenhouse gasses. For example, the production of a single beef burger patty requires about 2,2500 liters of water. In comparison, the average water footprint of a soy patty is just 158 liters.43

Adding products such as plant-based burgers allow you to highlight your sustainability efforts – which is good for the environment, your consumers, and, of course, your business.

6) Plant-based options keep costs low

Contrary to popular belief, plant-based food does not have to be expensive. In fact, shifting to more plant-based ingredients is likely to save you money!

Whole-plant foods such as vegetables and legumes are generally cheaper than animal-based products and also experience less price volatility. By replacing animal ingredients or adjusting the plant/animal ratio in dishes, you can easily reduce costs.

Blending plant and animal protein is common in Europe, as well as in the US college and university food-service sector. This approach allows you to add the health and sustainability appeal of plant protein while also keeping the product familiar to consumers.

Plant-based alternatives also have greater longevity and many are shelf-stable, which can help to save storage space and reduce the frequency of ordering stock.

7) Plant-based menu items make you stand out from the crowd

Regardless of whether you work in a restaurant, canteen, café, or another type of food-service company, the traditional offerings in your industry most likely rely heavily on animal-based ingredients. Offering plant-based options can differentiate a restaurant from its competitors by generating interest in a restaurant’s menu, infusing innovation and creativity in its offerings, and aligning a brand with its customers’ values, thus making you stand out from the crowd.

A survey conducted by RMS found that, between January and August 2020, the proportion of consumers who stated that they would switch to a restaurant brand offering plant-based products increased from 23% to 30%.44

This illustrates the importance of having at least one plant-based item on your menu. For some people, this availability plays a key role in choosing a restaurant, with two in five family households and one in four single households stating that they would switch to another restaurant brand if it offered plant-based meats.45

8) Plant-based products get media attention

As plant-based menu options continue to garner press headlines and social-media shares, restaurants should capitalize on the interest in the sector. With many celebrities highlighting the benefits of a plant-based lifestyle, and brands such as Impossible and Beyond seeing their sales rapidly increase due to viral media attention in mainstream news channels, plant-based menu items have the potential to skyrocket restaurants into consumers’ news feeds.

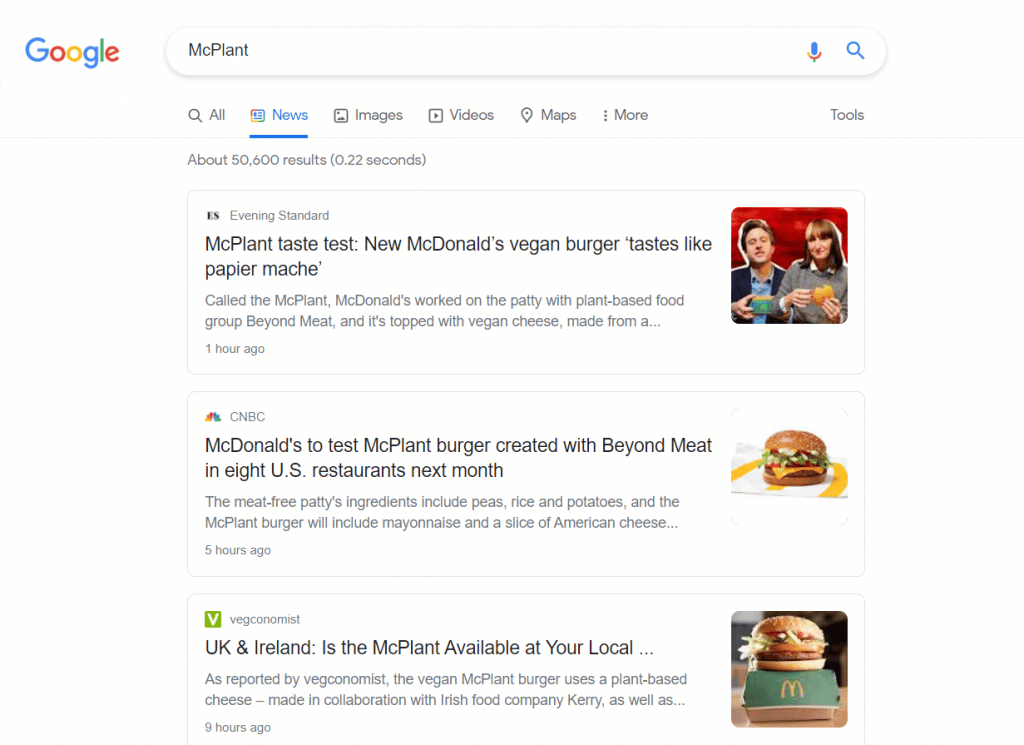

Consider McDonald’s launch of the McPlant, for example. The UK press was talking about the launch as early as 2019, three years before it officially kicked off in the UK. A quick Google search the day after the official launch showed just how many people were talking about it!

Image source: Copyright Google.com

Launching plant-based menu items can be a great opportunity to build your brand and increase awareness.

Now that you know why you should consider adding plant-based options to menus, let’s explore the ‘how’. First, let’s take a look at some examples of best practices and unique culinary experiences.

Case Study: Michelin-starred restaurants

Let’s start with a restaurant that has pivoted to being completely vegan. Early in 2021, Eleven Madison Park, one of New York City’s ritziest three-Michelin-star restaurants, announced that its menu would become entirely plant-based, with chef and owner Daniel Humm saying that, “The current food system is simply not sustainable, in so many ways.”

The restaurant used ingredients such as vegetables, fruits, legumes, fungi, grains, and more, to create dishes with the same level of flavor as before. Dishes included a caviar-style tonburi with baby lettuce and peas; eggplant with tomato and coriander, served with summer beans and corn; and summer squash with marinated tofu.

The strategy was clearly a hit with consumers. Early in 2021, the waitlist for diners was already more than 50,000 people long. When reservations for October came online, virtually all the tables for two disappeared within minutes, even though diners had to pay the full $335 menu price in order to secure a table.46

By completely overhauling the menu to being fully plant-based, Eleven Madison Park has captured the attention of mixed eaters, flexitarians, and vegans alike.

Similarly, Michelin-star chef Alexis Gauthier turned his London restaurant completely vegan in early 2021 – despite pushback from customers. The French chef says he’s been working towards a 100% plant-based menu for a number of years now at his brasserie Gauthier Soho. The restaurant serves an evening tasting menu made completely from plants, including a summer truffle tortellini, harissa cauliflower, and a very dark chocolate tart. When the restaurant first opened with its plant-based menu, Alexis said he expected to lose loyal customers – but that turned out not to be the case.

Gauthier’s gamble paid off. The restaurant’s plant-based tasting menu has been so successful that he has just opened a second, more casual vegan restaurant named 123V.

Case Study: Chain Restaurants

Another great example of a restaurant harnessing the power of plant-based menu items is Pizza Express in the UK. The chain serves a wide variety of plant-based options, from veganised PizzaExpress classics to plant-based calzones and desserts. The menu now includes 25 mains, six starters and sides, and three desserts, with a popup Vegan PizzaExpress opening in celebration of the brand new menu. This incredible PR opportunity created a huge buzz for the chain in B2B and B2C media, clearly showcasing the extensive plant-based options available.

Another eatery to watch is UK restaurant chain Wagamama, which recently launched its ‘Plant Pledge’, a campaign to encourage guests to eat more plant-based dishes to help tackle the climate emergency, in response to the UN’s latest environmental report.

In 2020, Wagamama became the first major restaurant chain to offer vegan tuna, offering a product created with watermelon. For the 2021 edition of Veganuary, the chain launched a range of new vegan menu options and stated its aim of making half its main-menu options meatless by the end of 2021. Global Executive Chef Steve Mangleshot and his team have now confirmed that 50% of the menu will officially be plant-based.

Wagamama is urging guests to pledge a ‘small choice for big change’, whether it’s trialing plant-based for the first time or making a meal a week plant-based. As part of the Plant Pledge, Wagamama will encourage people to get started on their journey by offering a free vegan side order when they sign up.

Although we don’t yet know the outcomes of the campaign pledge, promotions around consumer-education campaigns offer a great opportunity to increase awareness and sales. The campaign also has a strong appeal for sustainability-conscious consumers, encouraging them to choose Wagamama, since doing so aligns with their values.

Case Study: Convenience food service

It’s not just restaurants making the move into the plant-based arena. Convenience food service is also harnessing the momentum of the movement. British pie-maker Greggs, for example, recently launched two new plant-based options, expanding its vegan range following the viral success of its vegan sausage roll when it launched back in 2019. And high-street sandwich shop chain Pret A Manger celebrated Veganuary with the launch of nine new plant-based menu options. With its new meatless wrap, Pret was keen to show its customers that choosing plant-based options doesn’t mean compromising on taste. In fact, the company was so sure that its customers would enjoy its vegan meatball wrap that it didn’t sell the meaty version for an entire month.

Pret recently revealed plans to open over 200 more shops in the UK in the next two years, and although this is not specifically attributed to its plant-based options, it does hint at the success that the chain has been experiencing in recent times.

Case Study: Cultured meat as the future of food services

The future is even more exciting, since, as you’ll see, it’s not just about plant-based menu items, but also cultured meat! In a first-of-its-kind initiative, Israeli startup SuperMeat opened a restaurant test kitchen In Tel Aviv called The Chicken. They offer cultured-chicken filets for customers to sample, in the process normalizing cell-based meats and bringing them closer to commercialisation. While they dine, customers can also peek into SuperMeat’s factory, where they can see their chicken burgers being manufactured under the same roof.

This is a great look into the future of food service! Chefs will be cooking cultured-meat products long before they go into retail, and so will have the chance to really influence consumer perception around this exciting innovation.

Key Learnings on how to best implement a plant-based strategy

Substitute animal ingredients with natural plant-based alternatives

Plant-based ingredients are typically healthier by design. Using natural plant-based ingredients to replace animal ingredients on your menu can be a great way to appeal to consumers craving a healthier but still decadent choice.

According to market-research firm Nielsen, 38% of US consumers associate plant proteins with positive health effects.47 Echoing this, Datassential’s Plant-Based Eating Keynote Report found that the number-one reason why US consumers are eating more plant-based foods, as chosen by 49% of respondents, is because they perceive them to be healthier.48

Labeling and menu integration is critical

The name of a dish is very important. A plant-based dish often sells better when it is not overtly presented as such – otherwise, the impression might be created that the offering is intended only for vegans and vegetarians. So, instead emphasize the diverse characteristics of the dish (taste, sustainability, and health factors) rather than its ‘veggie-ness’. For plant-based customers, a simple icon such as a ‘V’, a leaf, or a carrot, will suffice. Another approach is to make the plant-based version of a meal the default option.49

In a study conducted at Stanford and published in the JAMA Internal Medicine journal, four different descriptors were used for the same dish:

- “Green beans” (basic description)

- “Light ’n low-carb green beans & shallots” (healthy restrictive description)

- “Healthy energy-boosting green beans & shallots” (healthy positive description)

- “Sweet sizzlin’ green beans and crispy shallots” (indulgent description)

The indulgent labeling description led to people ordering the green beans 25% more than the basic description, 35% more than the healthy positive description, and 41% more than the healthy restrictive description.50

The positioning of plant-based options on the menu also plays a major role. In a study undertaken by the London School of Economics, orders for plant-based items doubled among non-vegetarians simply by including such dishes in the main menu, instead of in a specific category.51

Taste, price, and familiarity equates to high sales:

According to a study on implicit purchasing in the plant-based category, the primary considerations when deciding whether to purchase a plant-based product all relate to how the product will benefit the individual consumer. Taste is the most influential consideration across all age groups and diet types.52

Today’s consumers are always looking for new and exciting taste experiences. The emerging plant-based food sector has proven to be a rich source of innovation and can help provide the novelty and variety that consumers crave. A plant-based diet often serves as a gateway to leaving the familiar path and exploring new products, flavors, and ways of preparing food, while finding inspiration in both the latest food science and age-old culinary traditions from around the world. Impress your guests with delicious taste experiences and they will be more likely to choose a plant-based option in the future, regardless of their usual dietary preferences.

Tradition and familiarity are also influential considerations in this category. In general, consumers display a preference for plant-based meat products that are familiar over those that seem novel. This is especially the case for traditional meat consumers, who have the strongest need for plant-based meat to match the sensory properties of conventional meat.53

The success of products such as the Beyond Burger and the Impossible Burger shows that consumers want a familiar, craveable experience that’s healthier, more eco-friendly, and animal-free. Food familiarity is key for flexitarians – they might eat a plant burger one night and an animal-based burger the next night.54

Price is also a contributing factor. In a recent study conducted by ProVeg International and the Smart Protein project, 52% of European consumers thought that plant-based products were too expensive and 48% said that they were unlikely to pay more for plant-based products.55 Therefore, it’s vital to ensure that your plant-based menu items have price parity with their animal-based counterparts.

ProVeg’s 5 key recommendations for success

Lead with flavor

Plant-based menu items shouldn’t be an afterthought or a blend of random vegetables. Rather, they should be positioned as equally indulgent and flavourful as other dishes, with the additional health and environmental benefits of plant protein. Plant-based cooking can be tasty and innovative.

“The culinary art of vegan, sustainable, and compassionate cuisine needs to be showcased by talented chefs.”

Showcase sustainability

Adding products such as plant-based burgers gives you a great PR opportunity to highlight your sustainability efforts. For example, swapping just one beef patty for an Impossible Burger saves the emissions equivalent of driving 29 km.57

Consider flexitarian consumers

Always think about targeting flexitarian consumers by creating the delicious and familiar products that they crave, and showcasing these plant-based menu items with indulgent descriptions seamlessly integrated into the main section of the menu.

Harness the health benefits

Plant-based menu items are nearly always healthier than their animal-based counterparts. With the aforementioned research from Nielsen demonstrating that 38% of US consumers associate plant proteins with positive health effects, using natural ingredients and putting plant-based meat and dairy on your menu can be a great way to appeal to consumers who are craving a healthier but still decadent choice.58

Make sure to have a range of plant-based entrees on your menu that fits with your brand

With veganism becoming increasingly mainstream, restaurants can be vetoed for group bookings if they don’t offer tasty plant-based options. Having a range of plant-based entrees on the menu, will ensure that you’ll appeal to a broader market of vegans, vegetarians, flexitarians, and environmentally and health-conscious consumers, as well as those who are curious or simply looking for an alternative dining experience.

Conclusion

With the global plant-based food sector predicted to exceed $162 billion within the next decade59, and an increasing number of restaurants offering plant-based menu items or even pivoting to being completely plant-based, it’s more important than ever to harness the power of foods that are delicious and good for humans, animals, and our planet.

If you’d like some support in transitioning your menu towards more plant-based options, please get in touch with us at [email protected].

References

- Mattson (2017): Meteoric rise in flexitarian eating and how HPP can play a role. Slides presented at the 2017 HPP Summit, Atlanta, GA.

- ING Research (2020): Big things have small beginnings. Growth of meat and dairy alternatives is stirring up the European food industry. Available at https://think.ing.com/uploads/reports/ING_report_-_Growth_of_meat_and_dairy_alternatives_is_stirring_up_the_European_food_industry.pdf (last accessed 19.10.2021).

- Bloomberg Intelligence (2021): Plant-based foods poised for explosive growth, cited from Gelski, J (2021): Global plant protein market could hit $162 billion by 2030. Foo Business News. Available at https://www.foodbusinessnews.net/articles/19347-global-plant-protein-market-could-hit-162-billion-by-2030 (last accessed 19.20.2021).

- Bloomberg Intelligence (2021): Plant-based foods poised for explosive growth, cited from Gelski, J (2021): Global plant protein market could hit $162 billion by 2030. Foo Business News. Available at https://www.foodbusinessnews.net/articles/19347-global-plant-protein-market-could-hit-162-billion-by-2030 (last accessed 19.20.2021).

- Bloomberg Intelligence (2021): Plant-based foods poised for explosive growth, cited from Gelski, J (2021): Global plant protein market could hit $162 billion by 2030. Foo Business News. Available at https://www.foodbusinessnews.net/articles/19347-global-plant-protein-market-could-hit-162-billion-by-2030 (last accessed 19.20.2021).

- Bloomberg Intelligence (2021): Plant-based foods poised for explosive growth, cited from Gelski, J (2021): Global plant protein market could hit $162 billion by 2030. Foo Business News. Available at https://www.foodbusinessnews.net/articles/19347-global-plant-protein-market-could-hit-162-billion-by-2030 (last accessed 19.20.2021).

- Happy Cow. The Veggie Blog (n.y.): The growth of vegan restaurants in Europe. Available at https://www.happycow.net/blog/the-growth-of-vegan-restaurants-in-europe/ (last accessed 19.10.2021).

- Happy Cow. The Veggie Blog (n.y.): The growth of vegan restaurants in Europe. Available at https://www.happycow.net/blog/the-growth-of-vegan-restaurants-in-europe/ (last accessed 19.10.2021).

- Happy Cow. The Veggie Blog (n.y.): The growth of vegan restaurants in Europe. Available at https://www.happycow.net/blog/the-growth-of-vegan-restaurants-in-europe/ (last accessed 19.10.2021).

- Happy Cow. The Veggie Blog (n.y.): The growth of vegan restaurants in Europe. Available at https://www.happycow.net/blog/the-growth-of-vegan-restaurants-in-europe/ (last accessed 19.10.2021).

- Happy Cow. The Veggie Blog (n.y.): The growth of vegan restaurants in Europe. Available at https://www.happycow.net/blog/the-growth-of-vegan-restaurants-in-europe/ (last accessed 19.10.2021).

- Happy Cow. The Veggie Blog (n.y.): The growth of vegan restaurants in Europe. Available at https://www.happycow.net/blog/the-growth-of-vegan-restaurants-in-europe/ (last accessed 19.10.2021).

- cited from Von Alt, S (2018): New study finds 51% of chiefs have added vegan menu items in 2018. ChooseVeg. Available at https://chooseveg.com/blog/51-percent-of-chefs-add-vegan-menu-items/ (last accessed 19.10.2021).

- Beyond Meat (2021): Beyond breakfast sausage debuts in the UK at Starbucks. Available at https://www.beyondmeat.com/whats-new/beyond-breakfast-sausage-debuts-in-the-uk-at-starbucks (last accessed 19.10.2021).

- Pritchett, L (2020): KFC China launches vegan chicken by Cargill. LiveKindly. Available at https://www.livekindly.co/kfc-china-vegan-chicken-nuggets-cargill/ (last accessed 19.10.2021).

- Tyson Foods (2020): Tyson Foods expands Raised&Rooted brand to Europe. Available at https://www.tysonfoods.com/news/news-releases/2020/11/tyson-foods-expands-raised-rooted-brand-europe (last accessed 19.10.2021).

- Chiorando, M (2020): McDonald’s vegan ‘McPlant’ range shows ‘future of meat is plant-based’, says food expert. Available at https://plantbasednews.org/lifestyle/food/mcdonald-vegan-mcplant-range-future-meat-plant-based/ (last accessed 19.10.2021).

- McCann, K (n.y.): Should your restaurant add vegan menu options. TouchBistro. Available at https://www.touchbistro.com/blog/should-your-restaurant-add-vegan-menu-options/ (last accessed 19.10.2021).

- Financial Times (2021): Veganism gies haute cuisine. Available at https://www.ft.com/content/2659dbf4-7209-4094-8327-bdf0dde9eadd (last accessed 19.10.2021).

- Mattson (2017): Meteoric rise in flexitarian eating and how HPP can play a role. Slides presented at the 2017 HPP Summit, Atlanta, GA.

- Smart protein project (2021): What consumers want: a survey on European consumer attitudes towards plant-based foods, with a focus on flexitarians’, European Union’s Horizon 2020 research and innovation program (No 862957). Available at https://smartproteinproject.eu/consumer-attitudes-plant-based-food-report/ (last accessed 31.01.2021).

- Smart protein project (2021): What consumers want: a survey on European consumer attitudes towards plant-based foods, with a focus on flexitarians’, European Union’s Horizon 2020 research and innovation program (No 862957). Available at https://smartproteinproject.eu/consumer-attitudes-plant-based-food-report/ (last accessed 31.01.2021).

- Smart protein project (2021): What consumers want: a survey on European consumer attitudes towards plant-based foods, with a focus on flexitarians’, European Union’s Horizon 2020 research and innovation program (No 862957). Available at https://smartproteinproject.eu/consumer-attitudes-plant-based-food-report/ (last accessed 31.01.2021).

- Gallup, (2020) Available at https://www.vox.com/future-perfect/2020/1/29/21110967/gallup-poll-plant-based-meat-vegan-climate-animals (last accessed 19.10.2021

- Mattson, (2020) Available athttps://gfi.org/wp-content/uploads/2021/05/COR-SOTIR-Plant-based-meat-eggs-and-dairy-2021-0504-1.pdf (last accessed 19.10.2021).

- Datassemtial’s MenuTrends, cited from The Good Food Institute (n.y.): Plant-based: The business case. Available at http://goodfoodscorecard.org/why-plant-based/#I1 (last accessed 19.10.2021).

- Cited from The Good Food Institute (n.y.): Plant-based: The business case. Available at http://goodfoodscorecard.org/why-plant-based/#I1 (last accessed 19.10.2021).

- Cited from The Good Food Institute (n.y.): Plant-based: The business case. Available at http://goodfoodscorecard.org/why-plant-based/#I1 (last accessed 19.10.2021).

- Whitelocks, S (2021): Wagamama and Frankie & Benny’s- owner Restaurant Group hails ‘good progress’ as profits bounce back to £11.2m but warns of staff shortages. This is MONEY. Available at https://www.thisismoney.co.uk/money/markets/article-9993011/Wagamama-owner-Restaurant-Group-hails-good-progress-11-2m-H1-profits.html (last accessed 10.10.2021).

- The NPD Group (2021): A plant-based twist on a restaurant classic, pizza. Available at https://www.npd.com/news/press-releases/2021/a-plant-based-twist-on-a-restaurant-classic-pizza/ (last accessed 19.10.2021).

- Cited from The Good Food Institute (n.y.): Plant-based: The business case. Available at http://goodfoodscorecard.org/why-plant-based/#I1 (last accessed 19.10.2021).

- Cited from The Good Food Institute (n.y.): Plant-based: The business case. Available at http://goodfoodscorecard.org/why-plant-based/#I1 (last accessed 19.10.2021).

- Food & Living Vegan (2020): Google searches for ‘vegan food near me’ skyrockets by over 2000%. Available at https://www.veganfoodandliving.com/news/google-searches-for-vegan-food-near-me-skyrockets-by-over-2000/ (last accessed 19.10.2021).

- Food & Living Vegan (2020): Google searches for ‘vegan food near me’ skyrockets by over 2000%. Available at https://www.veganfoodandliving.com/news/google-searches-for-vegan-food-near-me-skyrockets-by-over-2000/ (last accessed 19.10.2021).

- Food & Living Vegan (2020): Google searches for ‘vegan food near me’ skyrockets by over 2000%. Available at https://www.veganfoodandliving.com/news/google-searches-for-vegan-food-near-me-skyrockets-by-over-2000/ (last accessed 19.10.2021).

- Mohr, P (2021): What flexitarians want. FarmProgess. Available at https://www.farmprogress.com/marketing/what-flexitarians-want (last accessed 19.10.2021).

- NCP, cited from The Good Food Institute (2020): State of the industry report. Plant-based meat, eggs, and dairy. Available at https://gfi.org/wp-content/uploads/2021/05/COR-SOTIR-Plant-based-meat-eggs-and-dairy-2021-0504.pdf (last accessed 19.10.2021).).

- The Good Food Institute (2020): State of the industry report. Plant-based meat, eggs, and dairy. Available at https://gfi.org/wp-content/uploads/2021/05/COR-SOTIR-Plant-based-meat-eggs-and-dairy-2021-0504.pdf (last accessed 19.10.2021).

- Aramark, cited from Campisi, V (2020): Gen Z’s influential food preferences. The Food Institute. Available at https://foodinstitute.com/focus/gen-z-preferences/ (last accessed 19.10.2021).

- Mintel (2017): Protein report, cited from The Good Food Institute (n.y.): Plant-based: The business case. Available at http://goodfoodscorecard.org/why-plant-based/#I1 (last accessed 19.10.2021).

- ProVeg (2021) Plant-based foods in Europe: What do consumers want? Available at https://smartproteinproject.eu/consumer-attitudes-plant-based-food-report/ (last accessed 19.10.2021).

- Innova Market Insights, cited from Nunes, K (2021): Innova Market Insights names 2022’s top consumer trends. Banking Business. Available at https://www.bakingbusiness.com/articles/54898-innova-market-insights-names-2022s-top-consumer-trends (last accessed 19.10.2021).

- ProVeg (2021) Plan(t)s for Professionals Available at https://proveg.com/what-we-do/corporate-engagement/plants-for-professionals/ (last accessed 19.10.2021).

- RMS survey, cited from Recenue Management Solutions (2021): The impact of plant-based foods on restaurant recovery. Available at https://www.revenuemanage.com/en/blog/the-impact-of-plant-based-foods-on-restaurant-recovery/ (last accessed 19.10.2021).

- RMS survey, cited from Recenue Management Solutions (2021): The impact of plant-based foods on restaurant recovery. Available at https://www.revenuemanage.com/en/blog/the-impact-of-plant-based-foods-on-restaurant-recovery/ (last accessed 19.10.2021).

- Eater New York (2021) Eleven Madison Park Isn’t Ready to Be a World-Class Vegan Restaurant Available at https://ny.eater.com/22650875/eleven-madison-park-review-vegan-menu-dishes-price-2021(last accessed 19.10.2021).

- Nielsen Homescan Panel Protein survey US (April 2017), cited from The Good Food Institute (n.y.): How to win at plant-based: Toolkit. Available at http://goodfoodscorecard.org/how-to-win-at-plant-based/#I3 (last accessed 19.10.2021).

- Datassentrial’s Plant-based Easting Keynote Report, cited from The Good Food Institute (n.y.): How to win at plant-based: Toolkit. Available at http://goodfoodscorecard.org/how-to-win-at-plant-based/#I3 (last accessed 19.10.2021).

- Parry, J; Szejda, K (2020): Strategies to accelerate consumer adoption of plant-based meat. Recommendations from a comprehensive literature review. The Good Food Institute. Available at https://gfi.org/images/uploads/2020/03/FINAL-Consumer-Adoption-Strategic-Recommendations-Report.pdf (last accessed 19.10.2021).

- Turnwald, B P; Boles, D Z; Crum, A J (2017): Association between indulgent descriptions and vegetable consumption: Twisted carrots and dynamite beets. JAMA Intern Med. 177(8) pp.1216-1218. doi: 10.1001/jamainternmed. Available at https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2630753 (last accessed 19.10.2021).

- London School of Economics (2018): Menus with vegetarian sections can lead customers to eat more meat. Available at https://www.lse.ac.uk/News/Latest-news-from-LSE/2018/03-March-2018/Menus-with-vegetarian-sections-can-lead-customers-to-eat-more-meat (last accessed 19.10.2021).

- Parry, J; Szejda, K (2019): How to drive plant-based food purchasing. Key findings from a Mindlab study into implicit perceptions of the plant-based category. The Good Food Institute. Available at https://gfi.org/images/uploads/2019/10/GFI-Mindlab-Report-Implicit-Study_Strategic_Recommendations.pdf (last accessed 19.10.2021).

- Bloomberg Intelligence (2021): Plant-based foods poised for explosive growth, cited from Gelski, J (2021): Global plant protein market could hit $162 billion by 2030. Foo Business News. Available at https://www.foodbusinessnews.net/articles/19347-global-plant-protein-market-could-hit-162-billion-by-2030 (last accessed 19.20.2021).

- Cited from The Good Food Institute (n.y.): Plant-based: The business case. Available at http://goodfoodscorecard.org/why-plant-based/#I1 (last accessed 19.10.2021).

- ProVeg (2021) Plan(t)s for Professionals Available at https://proveg.com/what-we-do/corporate-engagement/plants-for-professionals/ (last accessed 19.10.2021).

- Cited from the Vegan Chef School. Available at https://theveganchefschool.com/about (last accessed 19.10.2021).

- Cited from The Good Food Institute (n.y.): Plant-based: The business case. Available at http://goodfoodscorecard.org/why-plant-based/#I1 (last accessed 19.10.2021).

- Nielsen Homescan Panel Protein survey US (April 2017), cited from The Good Food Institute (n.y.): How to win at plant-based: Toolkit. Available at http://goodfoodscorecard.org/how-to-win-at-plant-based/#I3 (last accessed 19.10.2021).

- Bloomberg Intelligence (2021): Plant-based foods poised for explosive growth, cited from Gelski, J (2021): Global plant protein market could hit $162 billion by 2030. Foo Business News. Available at https://www.foodbusinessnews.net/articles/19347-global-plant-protein-market-could-hit-162-billion-by-2030 (last accessed 19.20.2021).