Executive Summary

Giving up animal-based shelf space for plant-based alternatives is one of the best ways to improve your bottom line. Put simply, it’s what consumers want – the proof is in the numbers:

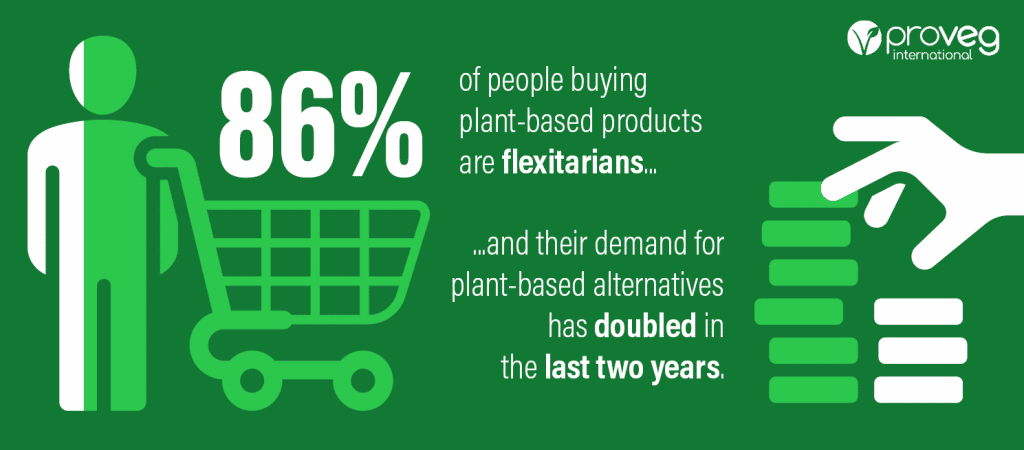

- 86% of people buying plant-based products are flexitarians1, and their demand for plant-based alternatives has doubled in the last two years.2

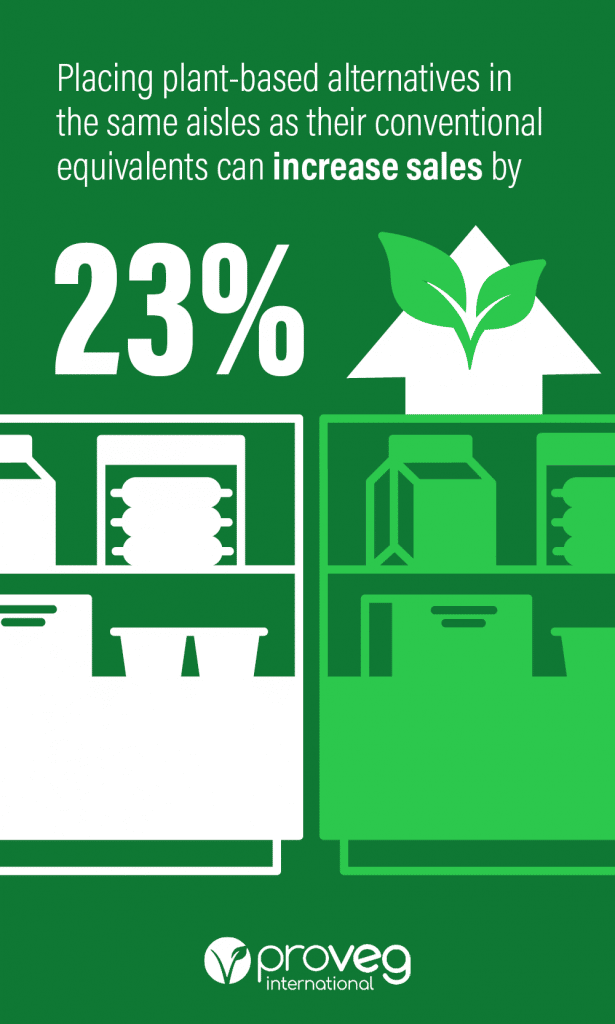

- Placing plant-based alternatives in the same aisles as their conventional equivalents can increase sales by 23%.3

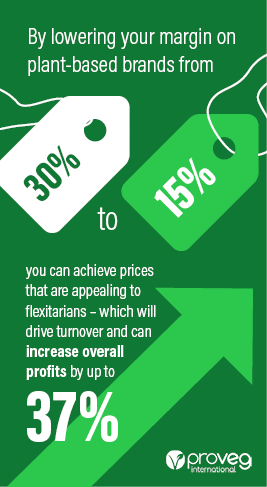

- By lowering your margin on plant-based brands from 30% to 15%, you can achieve prices that are appealing to flexitarians – which will drive turnover and can increase overall profits by up to 37%.4

Leading retailers are moving away from the conventional segmentation of animal-based and plant-based products and are embracing consumer demand for ‘protein aisles’ which offer both. Increasing your proportion of plant-based proteins is the best way to meet consumer needs, stay profitable, and meet your net-zero goals. Read on for more.

Introduction

Plant-based products now have mainstream appeal. They’re more profitable for retailers than animal-based products, and can massively boost your sustainability and net-zero targets. In this short paper, we’ll explain why you should be stocking more plant-based products, the benefits for your retail organization, and case studies of companies that are leading the way.

Let’s take a quick look at the retail opportunities:

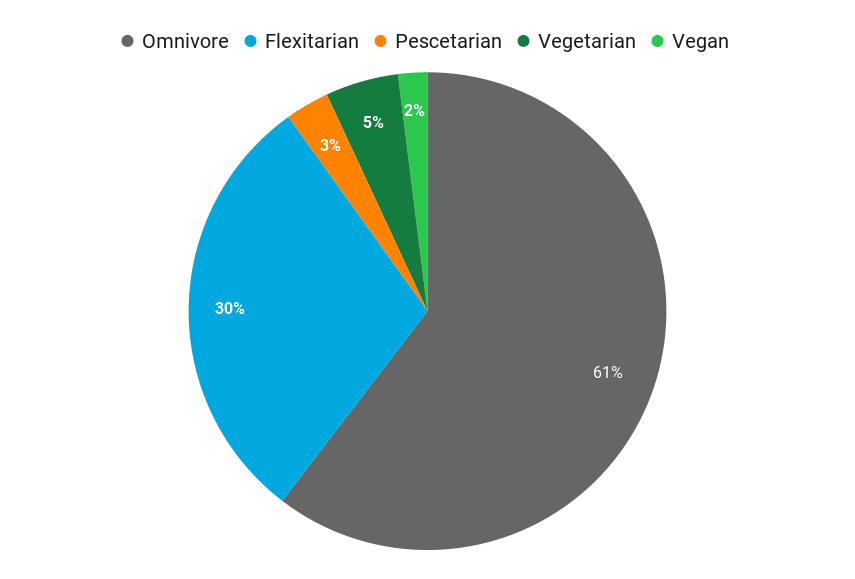

- High demand – 40% of European consumers are now actively reducing their consumption of animal-based products, and identify as vegan, vegetarian, pescetarian, or flexitarian.5

- Mainstream popularity – Plant-based meat is now a mainstream product, with 98% of US consumers buying such products alongside their animal-based-meat purchases.6

- Huge market – Bloomberg Intelligence predicts that the global market for plant-based alternatives will continue to grow explosively, from $29.4bn in 2020 to $162bn by 2030.7

- Higher revenue – Retailers can earn 37% more from existing flexitarian consumers by selling them lucrative own-label plant-based meats rather than animal-based meat. This is based on a retailer margin of 15% for plant-based and 8% for animal-based meats – and the revenue potential is even higher for premium plant-based brands.8

Merchandising essentials

Familiarity

Prioritize stocking plant-based alternatives over traditional animal-based products – consumers want familiarity but with new benefits that fit their lifestyle.

(Image source: ProVeg)

(For a detailed look at how familiar products and artwork can broaden the appeal of plant-based alternatives, check out our paper: ‘Convenience by design: how to make plant-based products easy for consumers’.)

Positioning

76% of consumers want to find plant-based alternatives in the meat or frozen sections where they usually shop.11 See our case studies below on US retailer Kroger and European retailer Lidl for proof of how this strategy can drive plant-based sales.

Quality & Price

Focus on indulgence first – meaning great taste and texture. Then make the price accessible – see our case study below on how Tesco and Co-op used price parity to drive plant-based sales. Other consumer considerations include health benefits (e.g. fiber, protein), followed by environmental factors (e.g. lower emissions, less deforestation, less water). This hierarchy of motivations should inform your broader marketing strategy, both in-store and online.1213

Benefits for retailers

Longer shelf life

Most plant-based products have a significantly longer shelf life than their animal-based counterparts. Chilled plant-milks are a great example, being able to last for months on the shelves. There are also increasing numbers of ambient and frozen plant-based products on the market, including popular snack ranges that are ideal for point-of-sale purchases.

Sustainability goals

The farming and eating of animals contribute almost 20% of global GHG emissions.14 That’s up to eight times more than aviation.15 Retailers can drastically reduce their emissions by replacing animal-based products with plant-based alternatives. Read on to see how Co-op UK is expanding its plant-based range to meet its net-zero targets.

Customer retention

The plant-based sector is becoming highly competitive as flexitarians drive demand. Sales of plant-based alternatives increased by 49% in Europe between 2018-20, and by 19.2% in the US between 2019-20.1617 Crucially, 86% of purchases of plant-based alternatives are made by flexitarian consumers.18

Retailers such as Tesco, Coop, Lidl, and Aldi have all launched extensive own-label plant-based ranges that offer price parity with animal-based products, thus ensuring that they remain one-stop shops for this new flexitarian mass market.

Case studies

Kroger: how integrated positioning drives sales

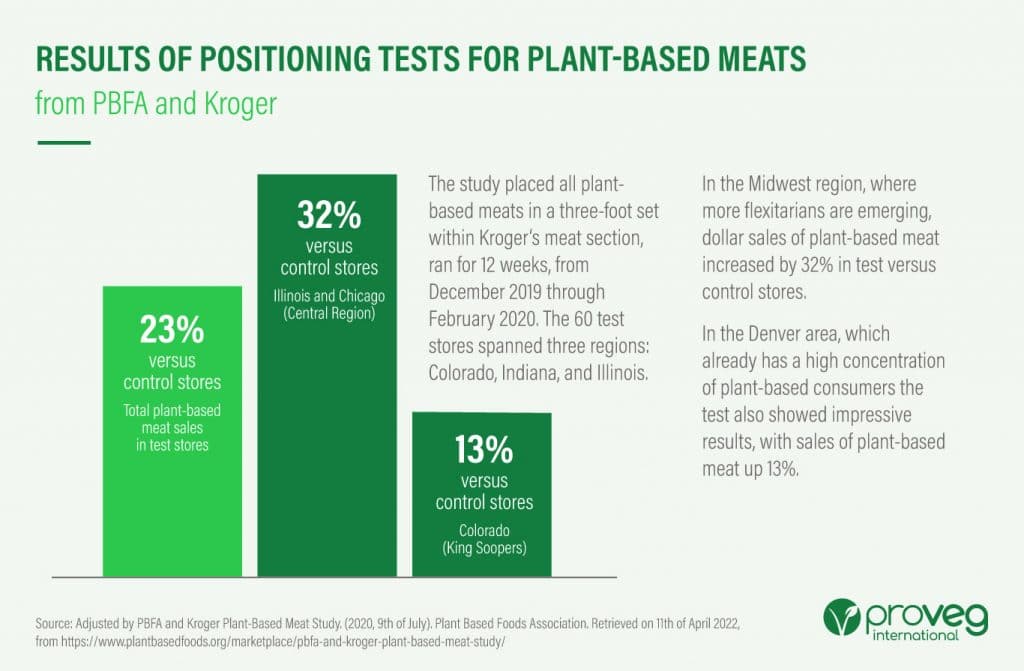

In 2019, US retailer Kroger partnered with the Plant Based Foods Association to test the impact of product positioning on plant-based sales. For the trial, Kroger placed plant-based meats in a three-foot set within the chilled animal-meat aisles. The trial spanned three months, sixty stores, and three regions. Half of the stores in each region were used as controls, while the other half tried the new embedded positioning.

The results were clear. By placing plant-based meats alongside their animal-based equivalents, Kroger increased sales of plant-based meats in every trial store – with an average increase of 23%.19

In Europe, Lidl’s partnership with ProVeg has been delivering similarly positive results. Lidl now stock more than 450 V-Label-certified products and is the first retailer to use the V-Label on price tags to highlight plant-based alternatives in-store. This is doubly significant because Lild’s plant-based products are now fully integrated into the store’s protein selection and placed next to their animal-based counterparts on the same shelves. In this way both, Lidl and Kroger are driving their plant-based sales through integrated positioning – making them more visible and easily accessible to mainstream consumers.

Asda: Meeting demand for plant-based ambient products

In 2020, Asda became the first major retailer in the UK to launch shelf-stable plant-based aisles – in all of its 359 stores. The aisles feature a sweet and a savory stack, and are home to over a hundred products, including private-label ranges. This move was a direct response to the retailer’s own survey data, which found that 17% of UK households are actively reducing or eliminating animal-based products from their diets. They also found a 275% increase in searches for vegan products on asda.com from 2019-2020.21

We understand that customers want a quick and simple shopping experience, and this shouldn’t be restricted by dietary requirements.”

ProVeg works with major retailers across Europe to help them optimize their plant-based revenues. Check out our full catalog of corporate services to find out more.

Co-op and Tesco: targeting flexitarians with price parity

In May 2021, Co-op UK became the first major retailer to introduce price parity with animal-based products for their entire own-label Gro range of plant-based products. They cut the prices on some products – including vegan sausages and burgers – by as much as 50%.

The price match is part of Co-op’s 10-point climate-change action plan which sets out the blueprint for the company to achieve net-zero by 2040 for both its direct and indirect carbon emissions. The competitively-priced yet high-quality Gro range has been a huge hit with the media and the public.

his move is a step in the right direction and we encourage other retailers and brands to consider making the change too.”

Tesco, the UK’s biggest retailer, followed shortly in the wake of Co-op’s move, expanding its range and slashing prices across its budget Plant Chef range.

We match prices to the equivalent product to make it easy for people to make the switch.”

This is part of Tesco’s broader environmental strategy, which saw the chain commit to increasing their meat-alternative sales by 300% by 2025.25 One of Tesco’s biggest meat suppliers, Samworth Butchers, has now opened a dedicated plant-based production facility to meet the rising demand from Tesco’s consumers.26

Lidl: developing new private-label products

European discount retailer Lidl wanted to expand their vegan range – and, like any good Ghostbuster fan, they knew who to call. ProVeg supported Lidl with the creation of an online product-configuration tool. We then activated our testing community to submit ideas for new plant-based products.

70,000 people participated in the online questionnaire, allowing ProVeg and Lidl to identify the best ideas for plant-based food products, and configure them to meet consumer preferences.

ProVeg further supported Lidl in planning and implementing a co-branded three-day co-creation workshop with Lidl’s employees and customers. We organized tasting sessions and held two keynote talks.

As a direct outcome of the workshop, in 2019, Lidl launched two new vegan products under their Next Level brand, and three more in January 2020. ProVeg supported Lidl in launching these new products through a co-branded social-media campaign, sharing recipes and ideas, and generating thousands of engagements.

In 2021, Lidl went further still. In partnership with ProVeg Germany, they launched 44 new plant-based products – across 3,200 stores nationwide – and are also rolling them out to other countries across Europe. Thanks to its partnership with ProVeg, Lidl has developed a strong plant-based image, and is on its way to becoming a one-stop shop for plant-based purchases.

ProVeg is ready to help your organization smash its plant-based goals. First, we’ll work with you to define your key questions and determine which regional markets, product categories, and consumer segments you should be targeting. Then, we’ll conduct primary and secondary research to comprehensively address these questions. Finally, we’ll present our key findings, with customized recommendations on the next steps needed to optimize your business. Our method worked wonders for Lidl, and we’d love to bring that same success to you. You can reach us at [email protected].

Conclusion

Expanding your plant-based range is a powerful way to attract and retain new mainstream flexitarian consumers. You can increase overall revenues by replacing the animal-based-meat products on your shelves with plant-based equivalents, while making huge progress towards your sustainability targets.

The fact that the vast majority of consumers buying plant-based products are flexitarians shows the incredible mainstream potential of these products. By increasing your plant-based range across categories, you can give consumers the nutritious, sustainable, and delicious products they’re demanding.”

For expert advice on plant-based merchandising, talk to us. ProVeg works across the whole value chain, supporting organizations to unlock the power of plant-based revenue. Get in touch at [email protected].

Note: ProVeg conducts exclusive interviews with a wide range of industry professionals for its New Food Hub white papers. Unless an alternative citation is provided, quotations are from those interviews. Some interviewees wished to remain anonymous.

References

- NPD Group consumer survey 2018, cited in press release https://www.benzinga.com/pressreleases/18/06/p11836149/plant-based-proteins-are-harvesting-year-over-year-growth-in-foodservi Accessed 2022-02-01

- Plant-based foods in Europe: How big is the market? Smart Protein Plant-based Food Sector Report by Smart Protein Project, European Union’s Horizon 2020 research and innovation program (No 862957) (2021). https://smartproteinproject.eu/plant-based-food-sector-report Accessed 2022-02-01

- Plant-Based Foods Association, “Plant-Based Meat Sales Increase an Average of 23% When Sold in the Meat Department”, July 2020, https://plantbasedfoods.org/plant-based-meat-sales-increase-an-average-of-23-when-sold-in-the-meat-department/ Accessed 2022-01-25

- ProVeg International, “3 Ways to Achieve Price Parity and Drive Sales”, https://corporate.proveg.com/article/3-ways-to-achieve-price-parity-and-drive-sales/

- Smart Protein (2021): What consumers want: A survey on European consumer attitudes towards plant-based foods. Country specific insights. European Union’s Horizon 2020 research and innovation program (No 862957) https://proveg.com/what-we-do/corporate-engagement/consumer-attitudes-plant-based-food-report/ Accessed 2021-12-02

- Nielsen, “Flexitarian is not a curse to the meat industry”, July 2019 https://nielseniq.com/global/en/insights/analysis/2019/the-f-word-flexitarian-is-not-a-curse-to-the-meat-industry/ Accessed 2022-01-25

- Bloomberg Intelligence, “Plant-based foods poised for explosive growth”, August 2021 https://share.getcloudapp.com/qGuJgpxR Accessed 2022-01-25

- ProVeg International, “3 Ways to Achieve Price Parity and Drive Sales”, https://corporate.proveg.com/article/3-ways-to-achieve-price-parity-and-drive-sales/

- Smart Protein (2021): What consumers want: A survey on European consumer attitudes towards plant-based foods. Country specific insights. European Union’s Horizon 2020 research and innovation program (No 862957) https://proveg.com/what-we-do/corporate-engagement/consumer-attitudes-plant-based-food-report/ Accessed 2021-12-02

- GFI, Accelerating Consumer Adoption of Plant-Based Meat, Feb 2020, https://gfi.org/images/uploads/2020/02/NO-HYPERLINKED-REFERENCES-FINAL-COMBINED-accelerating-consumer-adoption-of-plant-based-meat.pdf Accessed 2022-01-25

- The Annual Meat Conference 2019, https://www.fmi.org/docs/default-source/webinars/power_of_meat_2019_final_webinar.pdf?sfvrsn Accessed 2022-01-25

- Smart Protein (2021): What consumers want: A survey on European consumer attitudes towards plant-based foods. Country specific insights. European Union’s Horizon 2020 research and innovation program (No 862957) https://proveg.com/what-we-do/corporate-engagement/consumer-attitudes-plant-based-food-report/ Accessed 2021-12-02

- Parry, J and Szejda, K (2019): How to drive plant-based food purchasing: Key findings from a Mindlab study into implicit perceptions of the plant-based category. Research Report. Washington, DC: The Good Food Institute. Available at https://go.gfi.org/Mindlab-Strategic-Recommendations (last accessed 17.02.2022).

- “Global greenhouse gas emissions from animal-based foods are twice those of plant-based foods”, Xiaoming Xu et al., Nature Foods (2021-09-13)https://www.nature.com/articles/s43016-021-00358-x Accessed 2022-02-18

- https://ourworldindata.org/co2-emissions-from-aviation Accessed 2022-03-15

- Plant-based foods in Europe: How big is the market? Smart Protein Plant-based Food Sector Report by Smart Protein Project, European Union’s Horizon 2020 research and innovation program (No 862957) (2021). https://smartproteinproject.eu/plant-based-food-sector-report Accessed 2022-02-01

- FMI and Foundation for Meat & Poultry Education & Research, “The Power of Meat 2019”, https://www.fmi.org/forms/store/ProductFormPublic/power-of-meat-2019 Accessed 2022-02-01

- NPD Group consumer survey 2018, cited in press release https://www.benzinga.com/pressreleases/18/06/p11836149/plant-based-proteins-are-harvesting-year-over-year-growth-in-foodservi Accessed 2022-02-01

- Plant Based Foods Association, “Plant-Based Meat Sales Increase an Average of 23% When Sold in the Meat Department”, July 2020, https://plantbasedfoods.org/plant-based-meat-sales-increase-an-average-of-23-when-sold-in-the-meat-department/ Accessed 2022-01-25

- Data source: Plant Based Foods Association, https://www.plantbasedfoods.org/marketplace/pbfa-and-kroger-plant-based-meat-study/

- Asda (2020): Asda Becomes the First UK Retailer to Launch Ambient Vegan Aisle https://corporate.asda.com/newsroom/2020/09/21/asda-becomes-the-first-uk-retailer-to-launch-ambient-vegan-aisle Accessed 2022-04-14

- Image source: Asda, https://corporate.asda.com/newsroom/2020/09/21/asda-becomes-the-first-uk-retailer-to-launch-ambient-vegan-aisle

- Jo Whitfield, Co-op Food CEO cited by Co-op (2021): CO-OP TACKLES PLANT-BASED PRICE GAP WITH INDUSTRY-FIRST COMMITMENT https://www.co-operative.coop/media/news-releases/co-op-tackles-plant-based-price-gap-with-industry-first-commitment Accessed 2022-04-14

- Image source: Co-Op: https://blog.coop.co.uk/2021/05/05/weve-cut-the-price-of-our-plant-based-co-op-gro-range-to-make-it-more-affordable-for-everyone/

- Tesco (2020): Tesco commits to 300% sales increase in meat alternatives: https://www.tescoplc.com/news/2020/tesco-commits-to-300-sales-increase-in-meat-alternatives/ Accessed 2022-04-14

- Vegconomist (2021): Meat Product Manufacturer Opens Dedicated Plant-Based Facility to Supply Tesco With Vegan Products: https://vegconomist.com/company-news/meat-products-manufacturer-opens-dedicated-plant-based-facility-to-supply-tesco-with-vegan-products/ Accessed 2022-04-14

- Image source: https://www.discounto.de/Angebot/Next-Level-Bratwurst-3695514/